False Claims Act 2023 Year-End Update

Client Alert | March 4, 2024

2023 proved that there is never a dull moment when it comes to the False Claims Act (FCA). It was an especially significant year in terms of enforcement developments.

The Department of Justice (DOJ) recovered approximately $2.7 billion through FCA settlements and judgments, making FY 2023 the 15th straight year in which recoveries exceeded $2 billion. The government and whistleblowers initiated more than 1,200 new FCA matters—a new record and a 26% increase over the previous one. Moreover, DOJ initiated 500 of these matters, the most by far in any given year since DOJ began releasing data tracking this metric. Even relator-initiated matters were significantly higher than in past years; at 712, FY 2023’s total is the third-highest since 2000. Simply put, DOJ and the relators’ bar were more active in FY 2023 than ever before. Their efforts, as in past years, were focused primarily in the healthcare space—although this past year saw a marked increase in recoveries from defense contractors, as well.

Last year was notable in other ways, too. Four years after announcing its FCA cooperation credit policy, DOJ began explicitly acknowledging certain companies’ cooperation in settlement agreements. Yet it did so with varying degrees of specificity regarding what the companies did to earn such credit, resulting in—at best—limited guidance for companies to follow in evaluating options for self-disclosure, cooperation, and remediation. Elsewhere, DOJ deepened its commitment to pursuing FCA allegations in the cybersecurity realm, and multiple states expanded their false claims laws. And while few caselaw developments could rival the two Supreme Court FCA decisions handed down in the first half of 2023, the latter half of the year still saw significant Circuit‑level decisions related to materiality, damages calculations, and the FCA’s anti‑retaliation provision, among other topics.

We cover all of this, and more, below. We begin by summarizing recent enforcement activity, then provide an overview of notable legislative and policy developments at the federal and state levels, and finally analyze significant court decisions since the publication of our 2023 Mid-Year Update.

As always, Gibson Dunn’s recent publications regarding the FCA may be found on our website, including in-depth discussions of the FCA’s framework and operation, industry-specific presentations, and practical guidance to help companies avoid or limit liability under the FCA. And, of course, we would be happy to discuss these developments—and their implications for your business—with you.

I. FCA ENFORCEMENT ACTIVITY

A. NEW FCA ACTIVITY

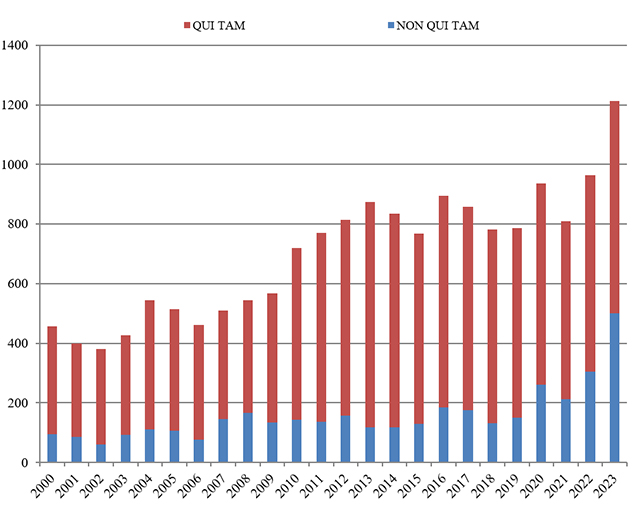

By a wide margin, 2023 was a record year for new FCA enforcement actions. More FCA cases were opened in 2023 than any year for which data is available. The government and qui tam relators filed 1,212 new cases, a stunning 249 more cases from the record set in 2022 (representing a 26% increase). And, as highlighted by DOJ, “[t]he government and whistleblowers were party to 543 settlements and judgments, the highest number of settlements and judgments in a single year.”[1]

This increase reflects DOJ’s laser-like focus on FCA enforcement. Last year, the government initiated 500 cases based on referrals or investigations, as opposed to qui tam matters. This far surpasses the prior record, set in 1987, of 340 government‑initiated cases, and outstrips the 305 matters opened the year before. Simply put, DOJ is aggressively seeking possible claims on its own initiative.

Historically, the vast majority of FCA recoveries have come from cases where DOJ initiated the case or intervened. Presumably, this portends significant FCA recoveries in years to come.

Number of FCA New Matters, Including Qui Tam Actions

Source: DOJ “Fraud Statistics – Overview” (Feb. 22, 2024)

B. TOTAL RECOVERY AMOUNTS

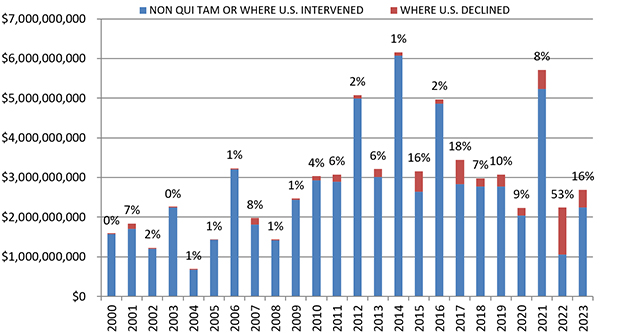

In FY 2023, the total dollars recovered through FCA cases (just shy of $2.7 billion) represented a significant increase over the previous year ($2.2 billion), though it remained far short of 2021’s most recent highwater mark ($5.7 billion).

Importantly, 2023 saw a return to normalcy in terms of the percentage of recoveries in which the United States either intervened or initiated the case. DOJ’s decision on whether to intervene historically has been a critical inflection point in cases—and one that strongly predicts whether a case will be successful. In short, DOJ is good at picking “winners.” FY 2022 presented a stark anomaly where more than half the FCA recoveries recorded (54%) stemmed from cases brought by a relator without the support of DOJ. This past year, FY 2023, 16% of recoveries came from qui tam actions in which the government declined to intervene, generally consistent with the overall trend and similar to numbers most recently seen in 2015 and 2017. Even that percentage, though, demonstrates the increase in the relators’ bar taking these cases into discovery and obtaining recoveries in recent years. Since 2014, relators have recovered a total of approximately four times more in FCA cases than in all other years since 2000 combined.

Assuming this indicator remains roughly consistent, we may soon see recoveries surpassing the record set in 2014, given DOJ’s aggressive initiation of cases in FY 2023.

Settlements or Judgments in Cases Where the Government Declined Intervention as a Percentage of Total FCA Recoveries

Source: DOJ “Fraud Statistics – Overview” (Feb. 22, 2024)

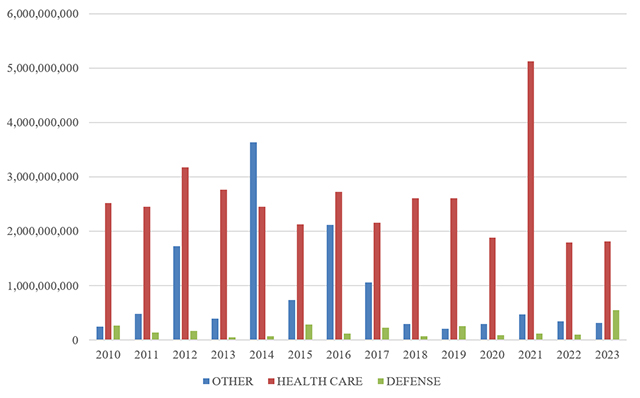

C. FCA RECOVERIES BY INDUSTRY

The breakdown of FCA recoveries by industry shifted marginally in 2023. Consistent with existing trends, healthcare cases accounted for the lion’s share of recoveries—68%, equating to more than $1.8 billion. That, however, represents the lowest portion of FCA recoveries since 2017 (then 63%). This shift is largely due to increased recoveries related to Department of Defense (DOD) procurement, which made up 21% of recoveries in 2023, equating to over $550 million. The remaining 12% of recoveries (nearly $320 million) were from cases involving other industries.

Regarding the healthcare-related claims, DOJ touted its cases alleging Medicare Advantage fraud, unnecessary services and substandard care fraud, claims related to the opioid epidemic, and unlawful kickbacks. Beyond those cases, DOJ emphasized its enforcement efforts targeting government defense contractors, as well as COVID-19 and cybersecurity fraud.[2]

FCA Recoveries by Industry

Source: DOJ “Fraud Statistics – Health and Human Services”; “Fraud Statistics – Department of Defense”; “Fraud Statistics – Other (Non-HHS and Non-DoD)” (Feb. 22, 2024)

II. NOTEWORTHY DOJ ENFORCEMENT ACTIVITY DURING THE SECOND HALF OF 2023

A. HEALTHCARE AND LIFE SCIENCE INDUSTRIES

- On July 13, a dermatology practice which operates 13 clinics in southeast Tennessee and north Georgia, and one of its dermatologists, agreed to pay $6.6 million to resolve allegations that they violated the FCA by overbilling federal healthcare programs for various dermatological surgeries and procedures. The government alleged that the practice and the physician falsely claimed that both the surgery and pathology portion of procedures were conducted by the dermatologist, when in fact certain portions were conducted by other individuals, and that the defendants regularly billed Medicare in a way that improperly bypassed Medicare’s “multiple procedure reduction rule.” As part of the settlement, the practice entered into a corporate integrity agreement (CIA) with the Department of Health and Human Services Office of the Inspector General (HHS-OIG), which focuses on the practice’s continuing obligation to properly bill and submit reimbursement claims to government payors. The settlement resolved a suit brought by a qui tam relator; the relator will receive $1.3 million of the settlement amount.[3]

- On July 14, an electronic health record (EHR) technology vendor agreed to pay $31 million to settle allegations that it violated the FCA and the federal Anti-Kickback Statute (AKS). The vendor allegedly misrepresented its software’s capabilities and falsely obtained certification from HHS under a program that grants incentive payments to incentivize healthcare providers that adopt EHR The vendor also allegedly provided unlawful remuneration to customers for referrals, including sales credits and tickets to sporting and entertainment events. This settlement is the latest in a series of resolutions with EHR vendors, including a $45 million settlement from late 2022 that we covered in our Year-End 2022 FCA Update. The settlement resolved a qui tam suit brought by two relators from a facility that used the company’s EHR software; the relators will receive nearly $5.6 under the settlement agreement.[4]

- On July 31, a Maine-based Medicare Advantage organization agreed to pay approximately $22.5 million to resolve allegations that it submitted inaccurate diagnosis codes for its enrollees, thereby increasing its reimbursements from Medicare. The government alleged that the provider reviewed the charts of its Medicare Advantage beneficiaries to identify additional diagnosis codes and then submitted those codes to Medicare although they were not supported by the patients’ medical records. The settlement resolved a qui tam suit brought by a former employee, who will receive approximately $3.8 million in the settlement.[5]

- On August 1, two pharmacy companies and their respective owners agreed to pay over $3.5 million to resolve allegations that they violated the FCA by billing Medicare for medications that were not actually dispensed. The companies also agreed to a five-year exclusion from participation in federal healthcare programs, surrendered their Drug Enforcement Agency (DEA) Certificates of Registration, and ceased operations.[6]

- On August 1, a clinical laboratory and its owner agreed to pay $5.7 million to settle an outstanding FCA judgment against them. An initial judgment of approximately $30.6 million was entered against the laboratory and owner in 2018 after a court found that the lab knowingly submitted false claims to Medicare for travel reimbursements. In particular, the court concluded that the lab billed Medicare for lab technician travel when specimens were not accompanied by technicians and billed travel for each specimen when groups of specimens were transported together. Due to the defendants’ inability to pay the original judgment in full, the laboratory and owner agreed to pay the new $5.7 million settlement over a period of five years. The settlement resolved a qui tam suit brought by the lab’s competitor, who will receive $1.3 million of the settlement. The settlement imposes future payment obligations in the event that certain contingencies transpire in relation to the laboratory owner’s income.[7]

- On August 10, a Florida-based durable medical equipment supply company agreed to pay $29 million to settle allegations that it fraudulently claimed reimbursement from Medicare and Medicare Advantage Plans for rental payments for oxygen equipment in excess of the 36-month cap on reimbursement. The settlement agreement stated that approximately $12.6 of the settlement amount constituted restitution. In conjunction with the DOJ settlement, the company also entered into a five-year CIA with HHS-OIG, which requires the company to undertake various compliance measures and to retain an independent compliance expert to review the company’s compliance program. The DOJ settlement resolved a qui tam suit brought by former employees, who will receive approximately $5.7 of the settlement amount.[8]

- On August 24, a Michigan pain management doctor and two pain center entities he owned and operated collectively agreed to pay $6.5 million to resolve a variety of FCA allegations. The government alleged that the doctor and entities billed Medicare and Medicaid for excessive and medically unnecessary urine drug tests irrelevant to patient treatment, additional laboratory charges not separately billable from the urine drug tests, routine moderate sedation services not actually required for interventional pain management procedures, and medically unnecessary or otherwise non-reimbursable back braces. The settlement resolves claims in two qui tam lawsuits, and the relators will collectively receive approximately $1.3 million of the settlement amount.[9]

- On August 30, a California company that operates multiple healthcare providers agreed to pay $5 million to resolve claims that it violated the FCA and the California FCA by causing the submission of false claims to California’s Medicaid program. The government alleged that the company billed for unallowable and/or inflated costs for services it provided to “Adult Expansion” population members (as defined under the Affordable Care Act). This settlement is the latest in a series of resolutions related to the Medicaid Adult Expansion program in California, through which the United States has recovered a total of $95.5 million. The allegations underlying the August 30 settlement stemmed from a qui tam suit by a former medical director, who will receive approximately $950,000 as his share of the recovery.[10]

- On September 13, a Texas company that managed and operated dermatology practices, surgical centers, and pathology laboratories across the United States agreed to pay approximately $8.9 million, including approximately $5.9 million in restitution, to resolve self-reported claims of potential violations of the FCA, the AKS, and the Stark Law. The government alleged that former senior managers of the company offered to increase the purchase price of 11 dermatology practices in exchange for agreements to refer laboratory services to affiliated entities after the acquisition. The government credited the company for self-reporting the alleged conduct at a time when the government was unaware of it. The settlement agreement itself, however, is not publicly available, and the press release announcing the settlement does not specify how much the cooperation credit reduced the amount the government otherwise would have sought to recover.[11]

- On September 15, a cardiac diagnostics company and its founder-owner agreed to pay approximately $4.5 million to resolve allegations that they paid physicians millions of dollars in the form of rent payments and referral fees to induce them to refer patients to the diagnostics company in violation of the AKS and the FCA. As part of the settlement, the government, the company and its founder-owner entered into a consent judgment for $64.4 million, which the government can seek to enforce if the required settlement payments are not made. The settlement agreement resolves a qui tam suit but does not specify the relator’s share of the recovery.[12]

- On September 30, a Connecticut-based healthcare and insurance company agreed to pay approximately $172 million to resolve allegations that it submitted, and failed to withdraw, inaccurate and untruthful diagnosis codes for its Medicare Advantage Plan enrollees. The government alleged that, as part of the company’s “chart review” program to identify all medical conditions that the charts supported and to assign the beneficiaries diagnosis codes for those conditions, the company added diagnosis codes that the patients’ healthcare providers had not included to inflate the payments the company received from the Centers for Medicare and Medicaid Services (CMS). In addition, the government alleged that the company failed to withdraw false diagnosis codes and repay CMS, including where the company itself added the codes and where providers included them initially and the company’s review did not support the use of the codes. Along with the settlement, the company entered into a five-year CIA with HHS-OIG, which requires (among other things) an independent review organization to audit the company with a focus on risk adjustment data.[13]

- On October 2, a Delaware-based specialty pharmacy and its CEO agreed to pay a total of $20 million to resolve FCA allegations premised on alleged AKS violations. Specifically, the government alleged that the company improperly waived Medicare and TRICARE patients’ copayments to induce patients to purchase the company’s services and specialty drugs, and that the company gave kickbacks to physicians to induce referrals in the form of gifts, dinners, and free administrative and clinical support services. The settlement stemmed from a qui tam suit brought by two former employees of the company, who together will receive approximately $4 million of the recovery.[14]

- On October 2, a California-based provider of genomic-based diagnostic tests agreed to pay $32.5 million to resolve allegations that it violated the FCA by improperly billing Medicare for the company’s principal laboratory test. In particular, the government alleged that the company violated the Medicare “14-Day Rule,” which governs reimbursement for laboratory tests for patients discharged after hospital stays. The settlement resolved two qui tam actions brought by two relators, who collectively will receive a share of approximately $5.7 million of the settlement.[15]

- On October 10, an Illinois-based cardiac imaging company and its founder agreed to pay approximately $85.5 million in an FCA resolution premised on alleged violations of the AKS and the Stark Law. The government alleged that the company paid above fair market value fees to cardiologists to supervise certain scans for patients the cardiologists referred to the company as improper referral; the fees allegedly included amounts for time that the cardiologists spent off-site or attending to other patients as well as for services beyond supervision that were not actually provided. The government also alleged that the company knowingly relied on a consultant’s fair market value analysis that was based on inaccurate information about the relevant services and that the consultant that provided the analysis later disclaimed. The company also entered into a five-year CIA with HHS-OIG, which imposes (among other obligations) an annual risk assessment and the retention of an independent review organization. The FCA settlement resolves a qui tam action brought by one of the company’s former billing managers, whose share of the government’s recovery had not been determined at the time the settlement was announced.[16]

- On October 17, multiple Michigan inpatient and hospitalist entities agreed to pay approximately $4.4 million to resolve allegations they violated the FCA by billing for services for beneficiaries located in Michigan and Indiana that were not rendered to the Michigan-based beneficiaries, permitting doctors to regularly bill impossible days of services, and by upcoding medical services (using more expensive billing codes than the codes corresponding to the services provided). The settlement resolves claims in two qui tam suits, with relators receiving approximately $767,000 of the settlement.[17]

- On October 30, a drug manufacturer and its founder agreed to pay at least $3.8 million and up to $50 million to resolve allegations that the company knowingly underpaid quarterly rebates to Medicaid programs for one of the company’s drugs. The government alleged that the drug manufacturer paused manufacturing of an acquired drug and later relaunched it as a reformulation (despite not changing any active ingredients) with a price increase of more than 400%. However, the manufacturer allegedly refused to pay the larger Medicaid rebate invoices tied to the price increase. The settlement amount is tied to certain financial contingencies.[18]

- On November 8, an eastern Kentucky hospital system and one of its physicians agreed to collectively pay approximately $3 million to resolve allegations that they violated the FCA by submitting claims for non-covered services to Medicare and Kentucky Medicaid. The government alleged that the hospital and physician billed, or caused to be billed, federal healthcare programs for reimbursement of services without the requisite documentation to support medical necessity of those services. The matter arose from the hospital system’s voluntary self-disclosure of the claims. The government stated explicitly that its recovery was limited to 1.5 times the amount of monetary loss caused by the alleged false claims, which is consistent with DOJ’s cooperation credit policy for FCA cases.[19]

- On November 9, DOJ announced that a healthcare management company, its executive, and six skilled nursing facilities agreed to a consent judgment in the amount of approximately $45.6 million to resolve claims that they violated the FCA and the AKS. The government alleged that under the direction and control of the management company and its executive, the skilled nursing facilities entered into medical directorship agreements that purported to compensate physicians for administrative services but actually provided kickbacks for physicians that referred patients to the skilled nursing facilities. The consent judgment calls for scheduled payments for each defendant based on their ability to pay, and the settlement contains a series of covenants by the government not to enforce the consent judgment as to certain assets, combined with provisions for increasing the payments owed by the defendants in the event of certain financial contingencies. In connection with the settlement agreement, the management company, one of the executives, and one of the skilled nursing facilities entered into a five-year CIA with HHS-OIG.[20]

- On December 6, a Pennsylvania-based company and its Illinois-based subsidiary agreed to pay more than $14.7 million to resolve allegations that they violated the FCA by knowingly submitting claims to federal healthcare programs for more expensive types of remote cardiac monitoring than what physicians had intended to order or that were medically necessary. According to the government, the companies ignored requests by physicians for types of monitoring that carried lower reimbursement rates than what the companies ended up billing. The settlement agreement resolved two qui tam actions brought by, respectively, an individual employee of one of the company’s customers and by an LLC. The individual will receive $2.3 million of the settlement share, and the LLC will receive approximately $270,000.[21]

- On December 19, a healthcare network agreed to pay $345 million to resolve allegations that it violated the FCA by knowingly submitting claims to Medicare for services that were referred to the network in violation of the Stark Law. In particular, the government alleged that senior management employed physicians and paid them above fair market value and in a way that took account of the volume of the physicians’ referrals to the network. The network allegedly continued this conduct despite warnings from a compensation valuation firm that the physician salaries exceeded fair market value. In connection with the settlement, the network entered into a five-year corporate integrity agreement with HHS-OIG. The settlement resolved a qui tam lawsuit brought by the network’s former Chief Financial and Chief Operating Officer, whose share of the recovery, according to the government “ha[d] not yet been determined” as of the time of the press release. The settlement agreement resolves only the allegations in the government’s partial complaint-in-intervention; as of this writing, the relator continues to pursue FCA claims premised on AKS allegations.[22]

- On December 20, a hospital operator agreed to pay $2 million, and to make additional payments in the event of certain contingencies, to resolve claims that the center violated the FCA. The government alleged that the center falsely claimed cost outlier payments—supplemental reimbursements by Medicare and TRICARE that aim to incentivize treatment for patients whose cost of care in an inpatient setting is particularly high. As part of the alleged conduct, the company improperly inflated its charges for inpatient care while underreporting charges on the cost reports it submitted to the government, and concealed an obligation to return outlier payments to which it was not entitled. The government also alleged that the company double‑billed the government for COVID-19 tests. The settlement resolved a qui tam suit brought by a former employee, who received approximately $300,000 of the settlement.[23]

- On December 21, a pharmaceutical company agreed to pay $6 million to resolve allegations that it violated the FCA by paying kickbacks in exchange for prescriptions. Specifically, the government alleged that the company knowingly paid for free genetic testing, as well as the associated fees; according to the government, the company knew the tests had to be positive for a certain genome in order for insurers to pay for the company’s medication. The settlement resolved a lawsuit brought by a qui tam relator, who will receive approximately $1.1 million of the federal settlement amount.[24]

- On December 21, a Missouri urgent care provider agreed to pay $9.1 million to settle allegations that it violated the FCA by submitting claims for physician services that actually were performed by non-physician practitioners. The settlement resolved allegations that the provider both upcoded billing for patient visits and submitted upcoded visit claims for COVID-19 vaccinations and patient care. The DOJ press release notes that the company “fully cooperated in the investigation,” but it is not clear whether DOJ awarded any cooperation credit on that basis. The press release did note that the company had voluntarily self‑disclosed separate conduct—the payment of bonuses to physicians in part based on the volume or value of referrals—to HHS-OIG in March 2021.[25]

- On December 22, a Pennsylvania manufacturer of durable medical equipment agreed to pay $2.5 million to resolve allegations that it violated the FCA by giving kickbacks to sleep laboratories. The government alleged that the manufacturer gave the laboratories free diagnostic sleep-respiratory disorder masks to induce prescriptions or referrals for masks the company manufactured for treatment of sleep disorders.[26]

B. GOVERNMENT CONTRACTING AND PROCUREMENT

- On July 21, a consulting firm agreed to pay approximately $377 million to resolve allegations that from 2011 to 2021 it violated the FCA by improperly billing unrelated or disproportionate costs to its government contracts. In particular, the government alleged that the firm billed the government for costs that were unallowable or that should have been allocated to commercial contracts instead of to government contracts. The settlement is the largest, by dollar value, since our 2023 Mid-Year Update, and is a rare example of an FCA settlement based on alleged violations of the federal cost accounting standards (CAS). The settlement resolved a qui tam suit brought by a former employee, who will receive almost $70 million of the settlement.[27]

- On July 21, two government contractors agreed to pay a total of $7 million to resolve allegations that they violated the FCA by falsely representing what methodology they used to measure customer satisfaction on certain government websites. The government alleged that the contractors were awarded a five-year contract with the Federal Consulting Group (a part of the U.S. Department of Interior) with the understanding that the company would measure customer satisfaction using the American Customer Satisfaction Index’s (ASCI) methodology, but that the company instead used a different methodology. The settlement resolves claims in a qui tam lawsuit brought by two relators, who will receive a total of $1.5 million of the settlement amount.[28]

- On August 4, an electronic connector manufacturing company agreed to pay approximately $18 million to settle allegations that it violated the FCA by submitting false claims for electrical connectors to the U.S. government and military. The company allegedly submitted claims for reimbursement of the connectors that did not meet the testing and manufacturing specifications required for the claims to be eligible for reimbursement.[29]

- On September 5, a New Jersey-based company paid approximately $4.1 million to resolve claims that it violated the FCA by failing to satisfy certain required cybersecurity controls in connection with information technology services provided to federal agencies. Specifically, the government alleged that the company failed to implement three required cybersecurity controls for Trusted Internet Connections with respect to General Services Administration (GSA) contracts from 2017 to 2021 within an internet protocol service it provided to federal agencies. The claims stemmed from a written self-disclosure of potential issues by the company, submitted to the GSA’s Office of Inspector General. The settlement agreement states that the company received credit for disclosure, cooperation, and remediation; although it does not specify the amount of the credit, it does detail certain cooperation and remediation steps the company took, such as identifying responsible individuals, disclosing facts it had gathered and attributing them to specific sources, assisting in damages calculations, and imposing employment consequences for responsible individuals.[30]

- On September 15, a Pennsylvania-based research and engineering services provider, agreed to pay $4.4 million to settle allegations that it violated the FCA by knowingly double billing for labor and material costs in relation to contracts with the U.S. Navy. The settlement agreement specifies that $2.1 million of the settlement amount constitutes restitution, and notes that there was a parallel administrative case that arose out of government audits of the relevant contracts and that the parties had agreed in principle to settle. It does not appear that there was a qui tam case underlying the settlement.[31]

- On September 28, a major military aircraft manufacturer agreed to pay $8.1 million to resolve allegations that it violated the FCA by failing to adhere to critical manufacturing requirements in the production of composite parts for certain aircraft sold to the United States military. The government alleged that the manufacturer failed to conduct routine checks and surveillance of machines used to cure certain composite parts, and that the manufacturer did not maintain required documentation concerning periodic testing of those machines. The settlement resolved a qui tam action by three whistleblowers who worked at the company’s manufacturing facility producing the composite parts; together they will receive approximately $1.5 million of the settlement.[32]

- On November 20, a Virginia-based tactical gear and equipment company agreed to pay nearly $2.1 to settle allegations that it submitted false claims in connection with the sale of “American-made” products that were actually manufactured in foreign countries in violation of the Trade Agreements Act and the Berry Amendment’s requirement that certain items purchased by DOD be 100% domestic in origin. The settlement resolved a qui tam suit brought by an employee, who will receive an unspecified portion of the settlement amount.[33]

C. OTHER

- On August 15, a Florida real estate broker and his companies agreed to pay $4 million to resolve FCA allegations that they knowingly provided false information in support of multiple Paycheck Protection Program (PPP) and Economic Injury Disaster Loan Program (EIDL) loans. The government alleged that the broker submitted false and fraudulent applications and documents, including false tax documents and employee wage reports, to obtain four EIDL loans and 14 PPP loans. The government also claimed that he submitted false and fraudulent forgiveness applications wherein he falsely certified that the entire loan amounts were used to pay eligible business costs.[34]

- On September 28, a Florida-based automotive company agreed to pay $9 million to resolve allegations that it violated the FCA by knowingly providing false information in support of a PPP loan application it submitted. The government contended that the company certified it was a small business and had fewer than 500 employees, making it eligible for PPP funds designated for “small business concerns” under the CARES Act. According to the government, the company in fact had over 3,000 employees, it knew when it made the certifications that it was ineligible for the loan program, and the government later forgave the loan. The settlement resolved claims brought in a qui tam lawsuit, and the relator will receive approximately $1.6 million of the recovery amount.[35]

- On October 31, an energy company agreed to pay $16 million to resolve allegations that it under-reported and under-paid natural gas royalties owed to the United States under administrative regulations for natural gas exploration. The government contended that the company knowingly deducted the costs of placing natural gas in marketable condition (which companies must do at no cost to the government) from the royalties it owed the government, knowingly deducted the costs of transporting carbon dioxide from the royalties, and knowingly failed to pay royalties on carbon dioxide. The settlement also resolved ongoing Department of Interior administrative proceedings regarding the same alleged conduct.[36]

- On November 1, a restaurant chain with locations in New York and Arizona and its owner agreed to pay $2 million to resolve allegations that they violated the FCA by falsely certifying that the restaurant chain was eligible to receive a Restaurant Revitalization Fund (RRF) grant in the amount of $928,554. Specifically, the government alleged that by falsely certifying that the restaurant chain did not have more than 20 locations, when in fact it had 21, the restaurant chain and its owner falsely claimed eligibility for the RRF grant. The settlement resolved a complaint filed by a qui tam relator whose share of the settlement will be $200,000.[37]

- On December 5, a Dallas-based importer of industrial products and two Chinese companies agreed to pay approximately $2.5 million to resolve allegations that they violated the FCA by submitting false invoices for customs valuations, which in turn resulted in lower values for the imported goods and lost customs revenue. The settlement resolved a qui tam suit brought by two relators, who received a $500,000 share as part of the settlement agreement.[38]

- On December 7, a New Jersey-based public relations firm agreed to pay nearly $2.3 million to settle allegations that the company violated the FCA by wrongfully taking a loan from the PPP. The United States contended that the company knowingly applied for and received a $2 million PPP loan, despite the fact that it was ineligible to receive the funds because it was a required registrant under the Foreign Agent Registration Act. The company allegedly later sought and received forgiveness for the total loan value. The settlement agreement states that the government considers approximately $2.1 million of the $2.3 million settlement amount to be restitution. The qui tam relator who brought the original lawsuit will receive $229,000, or 10%, of the recovery amount.[39]

- On December 11, a Texas‑based roofing company agreed to pay $9 million to resolve allegations that it violated the FCA by falsely certifying that eight of its affiliate companies were eligible to receive PPP loans in the amount of $6.7 million, which were all later forgiven in full. The government alleged that by improperly claiming to have fewer than 500 employees, each applicant falsely represented that it was qualified as a small business eligible to receive a loan, when the applicants’ affiliations with each other meant that they collectively had more than 500 employees. The settlement resolved a lawsuit brought by a qui tam relator who will receive $1 million of the settlement amount.[40] The law firm that represented the relator characterized it in a blog post as a “data miner” that “analyzes PPP loan data for prospective cases.”[41]

III. LEGISLATIVE AND POLICY DEVELOPMENTS

A. FEDERAL POLICY AND LEGISLATIVE DEVELOPMENTS

1. DOJ’s Cooperation Credit Policy, Several Years On

In the aggregate, FCA resolutions afford a fairly clear window into DOJ’s programmatic enforcement priorities. While any given settlement agreement’s level of detail regarding the covered conduct is often vigorously negotiated, agreements—and the press releases that announce them—typically contain enough high-level information about the nature of the government’s allegations for other companies in various industries to identify the government’s focus areas.

The government’s approach to awarding cooperation credit in FCA cases is markedly less transparent. In May 2019, DOJ issued a policy—now codified at Section 4-4.112 of the Justice Manual—regarding the circumstances under which such credit could be awarded.[42] At the core of the policy are voluntary disclosure, cooperation in the government’s investigation, and remediation.[43] In announcing the policy, DOJ stated that “[m]ost frequently, cooperation credit will take the form of a reduction in the damages multiplier and civil penalties,” and that DOJ “may publicly acknowledge the company’s cooperation.”[44] However, beyond that general statement, and a statement in the policy that cooperation credit cannot result in a defendant paying less than single damages, the policy said precious little about how much cooperation credit DOJ would award in various circumstances. (Gibson Dunn’s 2019 analysis of the policy provided further details on the policy and the significant discretion it granted to the government.)

The triad of disclosure, cooperation and remediation described in the FCA policy is a familiar one. In the criminal sphere, DOJ has made these same three concepts the centerpiece of its enforcement regime—not only from the standpoint of whether and how much cooperation credit to award, but also in terms of what type of resolution vehicle to use.[45] In the criminal enforcement context, however, DOJ tends to be more explicit about how much cooperation credit it awards and the factors that lead it to do so.

For example, several of DOJ’s new voluntary disclosure policies clarify that for a company that has made a qualifying self‑disclosure, DOJ will seek penalties of no more than 50% of the applicable criminal penalties, if the government determines criminal penalties are necessary.[46] These policies also make clear that companies that meet the policies’ criteria for disclosure, cooperation and remediation will not face guilty pleas absent aggravating factors.[47] Such policies also go beyond general pronouncements, and deal with more specific types of fact patterns that companies often face—the most notable example being DOJ’s recent “safe harbor” policy for companies that make voluntary self-disclosures regarding misconduct discovered in the course of mergers and acquisitions.[48] In the text of specific resolution agreements, moreover, DOJ frequently “shows its work” by explaining how much cooperation credit it is awarding and why. For example, in a recent deferred prosecution agreement with a commodities company related to alleged U.S. Foreign Corrupt Practices Act violations, the government explicitly awarded credit for cooperation efforts but not for voluntary disclosure, and stated that the company was receiving a 15% discount off the bottom end of the applicable U.S. Sentencing Guidelines penalty range.[49]

By contrast, nearly five years on from the codification of DOJ’s FCA cooperation credit policy, it is difficult to discern how DOJ is assessing the forms of cooperation and remediation the policy deems relevant, and to what effect in terms of settlement amounts. Before 2023, DOJ seldom invoked the policy as having affected the terms of a settlement when announcing resolutions. Although certain resolutions from 2023 reflect a possible shift toward more frequent discussion of the policy and provide valuable details about its application in practice, the statements DOJ is making continue to provide more questions than answers. Several examples from 2023 bear this out:

- In one of the year’s notable cybersecurity-related FCA resolutions, DOJ “acknowledged that [the company] took a number of significant steps entitling it to credit for cooperating with the government.”[50] These included a written self-disclosure to the GSA after the company learned of the relevant issues; “an independent investigation and compliance review of the issues and . . . multiple detailed supplemental written disclosures” to GSA; identification of responsible individuals to DOJ; disclosure of facts the company uncovered in its investigation, including by attributing the facts to specific sources; assistance to DOJ in the analysis of potential damages; and “prompt and substantial remedial measures” such as compliance enhancements, “substantial capital investments” in compliance initiatives, and employment consequences for responsible individuals.[51] The agreement, however, spends less than three lines stating that the company received cooperation credit; it does not specify which if any of the company’s efforts carried more weight than others in the government’s determination to award cooperation credit. The agreement did identify the portion of the amount that the government considered to be restitution; assuming this reflects DOJ’s views of single damages, then the total settlement amount was approximately 1.5 times the alleged single damages.[52]

- In another resolution involving a hospital system, DOJ did not publish the settlement agreement itself, but explicitly stated in the press release announcing the settlement that “[b]ecause the company self-reported the conduct to the government, it was able to resolve its False Claims Act liability for only 1.5 times the amount of monetary loss caused by its false claims.”[53]

The second example above suggests that voluntary self‑disclosure may be the engine of the cooperation credit analysis. Yet without more explicit statements from DOJ as to how it views companies’ disclosure, cooperation and remediation efforts, it is difficult to know which factors are ultimately responsible for any given award of cooperation credit.

On another level, while both examples above suggest that settlement at 1.5 times single damages is within reach for companies that satisfy DOJ’s policy, another resolution from 2023 awarded credit under the policy but reflected a reduction to only 1.75 times single damages. Further, like other resolutions, this one did not state which aspects of the companies’ efforts led DOJ to think that further reductions were inappropriate.[54] At the same time, DOJ has been known to settle at 1.5 times single damages—or even less—without any mention of self-disclosure, thus raising questions around the incentives for self-disclosure in the first instance. For example, in October, a New Jersey public relations firm reached a settlement of FCA allegations related to PPP funds, and the settlement amount was approximately 1.1 times the government’s stated restitution figure.[55]

In short, while DOJ’s more frequent invocation of its cooperation credit policy is a welcome development, for the time being it has done little to answer the questions the policy itself left open regarding the value of disclosure, cooperation, and remediation. Time will tell whether future resolutions will continue the recent trend of explicitly noting companies’ cooperation, and whether they will reflect a more detailed—and uniform—approach by DOJ to explaining how much cooperation credit it is awarding and why.

2. Civil Cyber-Fraud Initiative

Since announcing its Civil Cyber-Fraud Initiative in October 2021, DOJ has increasingly used the FCA to address cybersecurity concerns, and 2023 was no exception. The Civil Cyber‑Fraud Initiative uses the FCA to encourage disclosure and to hold accountable entities and individuals that put U.S. information or information systems at risk by knowingly providing deficient cybersecurity products or services, misrepresenting their cybersecurity practices or protocols, or violating obligations to monitor and report cybersecurity incidents and breaches.[56] Several recent cases highlight a growing trend of using the FCA to target government contractors that are required to meet certain cybersecurity requirements, even when no beach has occurred:

- In the cybersecurity-related FCA resolution mentioned above, the information services technology company paid $4.1 million to settle FCA allegations after self-disclosing potential issues with certain cybersecurity controls.[57] The company, which provides secure public internet connection capabilities to federal agencies, was contractually required to comply with the Office of Management and Budget’s Trusted Internet Connections initiative at all times. After identifying concerns with certain security controls that allegedly affected the company’s compliance with critical capabilities, the company self-disclosed the concern and implemented measures to remediate the issue.

- In a recently unsealed qui tam complaint stemming from the Civil Cyber-Fraud Initiative, a relator alleged that a university submitted false cybersecurity certifications to DOD. Despite making certifications of compliance with National Institute of Standards and Technology (NIST) requirements, the relator claims that the university failed to store controlling unclassified information in NIST-compliant applications, and replaced legitimate risk assessments with templates designed to simply “check the box.”[58]

These cases demonstrate that DOJ’s use of the FCA to pursue cybersecurity enforcement extends beyond commercial defense or cybersecurity-related contracts to any government agreement that includes representations about cybersecurity compliance. Healthcare companies should take note and pay particular attention to government contract provisions governing the storage, protection, and transmittal of protected health information and personal identifiable information, which may contain specific cybersecurity requirements or representations.

Cybersecurity enforcement will be an area to watch as it relates to self-disclosure in particular. In October 2023, DOD, the GSA, and NASA proposed a rule that would amend the Federal Acquisition Regulation (FAR) to require government contractors to disclose cybersecurity incidents within eight hours of discovering them, and to provide other periodic updates on efforts to remediate cybersecurity incidents.[59] Even though such disclosures to the government would not necessarily include information within the full scope of what it would consider relevant to possible FCA claims, the disclosures by definition will position the government to start investigating potential misconduct far closer in time to its occurrence than in other situations—even ones, such as the healthcare overpayment context, in which reporting to the government is required. The proposed FAR rule’s early reporting requirement could create additional incentives for federal contractors to quickly investigate and disclose potential FCA violations to DOJ, lest DOJ learn of the underlying cyber breaches too quickly for self-disclosure credit to be available. At the same time, it is possible DOJ will deem self-disclosure of potential FCA violations to carry less weight given that disclosure of the fact of a cyber incident would already be required by law. If the eight-hour disclosure provision remains in the FAR rule when it becomes final, it will be instructive to track the extent to which DOJ calibrates its application of the cooperation credit policy in the cyber context to focus on cooperation and remediation, as opposed to disclosure.

3. Other Federal Policy Developments

HHS-OIG Compliance Program Guidance

On November 6, 2023, HHS‑OIG released its new General Compliance Program Guidance (GCPG).[60] This document is designed to serve as a non-binding guide for healthcare entities, and includes guidance about compliance with the FCA and other applicable laws. The GCPG describes how the FCA in the healthcare context encompasses billing services or items to Medicare or Medicaid “where the service is not actually rendered to the patient, is already provided under another claim, is upcoded, or is not supported by the patient’s medical record.”[61] To ensure compliance with the FCA, the guidance recommends that entities take “proactive measures . . . including regular reviews to keep billing and coding practices up-to-date as well as regular internal billing and coding audits.”[62]

The guidance also outlines seven focus areas for corporate compliance programs, including policies and training, governance and reporting, risk assessments and audits, employment consequences, and responding to discoveries of misconduct.[63] In its discussion of risk assessments and auditing, the guidance makes clear that entities should put in place mechanisms for auditing the effectiveness of compliance controls, beyond simply auditing with an eye to identifying potential violations of law.[64] And the guidance emphasizes that an entity’s response to discovering misconduct should include self-disclosure to the appropriate government authority where “credible evidence of misconduct from any source is discovered and, after a reasonable inquiry, the compliance officer or counsel has reason to believe that the misconduct may violate criminal, civil, or administrative law.”[65] Notably, the guidance states that such disclosure should be made “not more than 60 days after the determination that credible evidence of a violation exists.”[66] It remains to be seen the extent to which this expectation ends up at odds with DOJ’s view of when an “obligation” to return healthcare overpayments arises under the Affordable Care Act (ACA) and the FCA, given that the ACA requires entities to return overpayments within 60 days of identifying them.[67]

HHS‑OIG has also signaled its intent to release industry segment-specific compliance program guidance in 2024 and to update the documents periodically.[68]

COVID-19 Enforcement

DOJ’s FCA enforcement efforts related to the COVID-19 pandemic are part of a broader landscape of civil and criminal enforcement initiatives to which DOJ has devoted significant resources over the last several years. In August 2023, DOJ provided an update on the efforts of its COVID-19 Fraud Enforcement Task Force.[69] According to DOJ, it had seized over $1.4 billion in COVID-19 relief funds as of that date, and had recently conducted a single coordinated enforcement effort involving 371 defendants and $836 million in relief funds, primarily from the Paycheck Protection Program, the Internal Revenue Service (IRS) Employee Retention Credit program, and Economic Injury Disaster Loans.[70]

B. STATE LEGISLATIVE DEVELOPMENTS

2023 saw states continue to expand the reach of their FCA statutes, some more aggressively than others. Most notably, as we discussed in our 2023 Mid-Year Update, New York became the first state to amend its FCA to cover persons who improperly fail to file a tax return in the state, obviating the need for the State or relators to show the person submitted an actual false “claim, record, or statement.” Connecticut also expanded the scope of its FCA statute to include claims relating to most state programs and benefits (although explicitly carving out tax-related claims), rather than only state-administered health and human services programs, as it had previously.[71]

More recently, New Jersey also amended its FCA statute. It did so specifically to qualify for the federal financial incentive that allows states to receive a ten-percentage-point increase in their shares of any amounts recovered under the FCA if the state’s laws meet certain specified criteria.[72] For a state to qualify for this incentive, HHS-OIG must determine that the state’s FCA is “at least as effective” as the federal FCA at facilitating qui tam actions.[73] With its bill, New Jersey implemented changes to bring the state’s law in line with HHS-OIG’s guidance. In addition to clarifying certain language and terminology to better align the statute with the federal FCA, the amendment expanded protections for relators by removing the bar preventing “an employee or agent of the State or a political subdivision from bringing an action based on information discovered in a civil, criminal, or administrative investigation or audit that was within the scope of the employee’s or agent’s duties or job description” and by expanding anti-retaliation protection to contractors and agents, beyond just employees.[74] With New Jersey’s amendment, there are now 23 state FCAs on HHS-OIG’s “approved” list and six on its “not approved” list.[75]

In Washington state, meanwhile, the legislature repealed a sunset provision that applied to whistleblower provisions, thus allowing qui tam actions to continue to be brought indefinitely.[76] The sunset provision was initially put in place to address the concern that the availability of qui tam actions would cause relators to indiscriminately file claims under the Washington FCA, but legislators found that this did not occur and the legislature’s Joint Legislative Audit and Review Committee unanimously recommended the bill repealing the sunset provision.[77]

IV. CASE LAW DEVELOPMENTS

A. The Third Circuit Weighs in on FCA Materiality Post-Escobar

The Supreme Court’s decision in Universal Health Servs., Inc. v. United States ex rel. Escobar, 579 U.S. 176 (2016), set forth a number of factors relevant to the potential materiality of a misrepresentation under the FCA. Among those factors are (1) whether the government has “designate[d] compliance with” the relevant “statutory, regulatory, or contractual requirement as a condition of payment”; (2) whether the alleged violation is “minor or insubstantial”; and (3) whether the government continued to pay claims “despite its actual knowledge that certain requirements were violated” or, instead, “consistently refuse[d] to pay claims in the mine run of cases based on noncompliance.” Id. at 194–95.

In late August, the Third Circuit addressed the interplay of these factors. In United States v. Care Alternatives, 81 F.4th 361 (3d Cir. 2023), the court reversed the district court’s grant of summary judgment to a defendant based on materiality. Relators in the case were former employees of Care Alternatives, a for-profit hospice provider. They alleged that Care Alternatives submitted Medicare claims even though patient records did not document hospice eligibility as required under 42 C.F.R. § 418.22(b)(2). Under that provision, for a patient to be eligible for hospice care paid by Medicare, a physician must certify that the patient is “terminally ill,” meaning that the physician has signed the certification with the knowledge that the patient’s medical record “‘support[s] the medical prognosis’ of terminal illness.” Id. at 366 (citation omitted). Relators alleged that Care Alternatives submitted claims that were accompanied by physician certifications of terminal illness, but that the patients’ records lacked sufficient clinical documentation “supporting that diagnosis.” Id. at 367.

The district court granted Care Alternatives’ first summary judgment motion based on a failure to show falsity; the Third Circuit reversed. (We covered the Circuit Court opinion in our 2020 Mid-Year Update.) Care Alternatives then filed a second motion for summary judgment. The district court again granted summary judgment to Care Alternatives, this time holding that relators had not established that the alleged misrepresentations to Medicare were material, given that the government continued to reimburse claims from Care Alternatives even after being made aware of the deficiencies in the underlying patient records.

The Third Circuit reversed and remanded, holding that the district court improperly assigned dispositive weight to a single factor under Escobar—that the government continued to reimburse despite knowing of the alleged clinical documentation deficiencies. The court concluded that a dispute of fact remained as to whether Care Alternatives’ alleged regulatory violations were “minor” or “went to the very essence of the bargain,” given that the parties contested the pervasiveness of the documentation errors, Care Alternatives’ awareness of its compliance problems, and whether the patients at issue were eligible for the Medicare hospice benefit. Id. at 370–72 (internal quotation marks omitted). And the court determined that, contrary to the district court’s opinion, a dispute of fact also remained as to whether the government ever had “actual knowledge” of the violation during the period in which it continued to reimburse Care Alternatives. Id. at 374–75. Noting that “relators are not required to conduct discovery on government officials to demonstrate materiality,” the court held that Care Alternatives had not met its burden of demonstrating an absence of dispute as to the timing of the government’s knowledge. Id. at 375.

B. The Fifth Circuit Overturns a Jury Verdict for the Government on Statute-of-Limitations Grounds

In United States v. Corporate Management, Inc., 78 F.4th 727 (5th Cir. 2023), a Medicare overbilling case, the Fifth Circuit heard an appeal following a nine-week jury trial that resulted in an approximately $10.8 million verdict for the government (roughly $32 million after trebling). Defendants appealed on a number of grounds, including that certain claims the government added when it intervened were untimely under the FCA’s statute of limitations. The relator filed the initial complaint in May 2007, alleging that Defendants had submitted false claims to Medicare, including by overbilling for supply costs. Id. at 734–35. The government did not intervene until September 2015. Id. at 735. In its complaint‑in‑intervention, the government added two claims, including a claim that Defendants “took advantage of Medicare’s 101% reimbursement rate” for critical access hospitals by setting up a sham “management fee” agreement between one such hospital and a management company owned by the hospital’s owner, which was used to improperly inflate salaries paid to the owner and his wife. Id. On appeal, Defendants argued that all claims accruing before September 2009, six years prior to the government’s complaint, were barred by the statute of limitations, and that the judgment should therefore be reduced to approximately $4.6 million. Id. at 741. The government argued that its claims related back to the relator’s original allegations that Defendants submitted fraudulent Medicare cost reports, or in the alternative, that the claims were viable in light of the FCA’s tolling period (which tolls the limitations period for up to three years “after the date when facts material to the right of action are known or reasonably should have been known by the official of the United States charged with responsibility to act in the circumstances”). Id.; 31 U.S.C. § 3731(b)(2).

The Fifth Circuit disagreed with the government on both arguments. It explained that to relate back, a new claim must be “tied to a common core of operative facts.” 78 F.4th 742 (internal quotation marks omitted). Whereas both the relator and the government alleged fraudulent cost reporting, the relator’s complaint contained no allegations regarding inflated salaries paid to the hospital owner and his wife. Id. at 743. Thus, rather than merely “add detail or clarify the claims on which it [was] intervening,” the government made new claims and sought to “‘fault [Appellants] for conduct different from that’ alleged by” the relator. Id. (internal quotation marks omitted). The Fifth Circuit further held that the government could not invoke the FCA’s three-year tolling provision, because there was evidence—in the form of a sealed government motion seeking an extension of the seal period—that an expert recommended in August 2011 that the government intervene in the case, and thus that by that time the government “likely did know” facts material to the case. Id. at 745 (emphasis in original). In reaching this conclusion, the court declined to decide whether DOJ or the relevant Medicare administrative contractor was the “official of the United States charged with responsibility to act in the circumstances” under the FCA’s tolling provision. Id.; 31 U.S.C. § 3731(b)(2).

C. The Ninth Circuit Imposes Limits on Calculation of Statutory Penalties and Upholds “Actual Damages” Framework

The FCA imposes a penalty for each violation of the statute, as well as “3 times the amount of damages which the Government sustains because of the act of” the defendant. 31 U.S.C. § 3729(a). In cases involving allegations that claims for payment were “tainted” by a defendant’s violation of an underlying contractual or regulatory requirement, FCA plaintiffs frequently seek penalties for every claim, and argue that the relevant goods or services were worthless to the government and that the proper measure of damages thus should be based on the full value of each claim.

In Hendrix ex rel. United States v. J-M Manufacturing Co., Inc., 76 F.4th 1164 (9th Cir. 2023), the Ninth Circuit reinforced important limitations on both of these theories. Relator and government entity plaintiffs in the case claimed that J-M violated the FCA by falsely representing that its PVC pipes were compliant with certain industry standards which measured compliance based on the material of the pipes and its performance under a series of tests, as well as the manufacturing process for the pipes. Under relevant standards, if the tested pipes are compliant, the manufacturer can claim compliance with those standards for pipes produced thereafter without additional testing, so long as the pipes are produced through “materially unchanged processes.” Id. at 1168.

During the first phase of a bifurcated trial, plaintiffs sought to prove that J-M continued to advertise its PVC pipes as compliant with industry standards after materially changing its manufacturing process from the pipes’ last compliance testing. At the end of Phase One, the jury found that J-M knowingly made materially false claims for payment because it represented in marketing materials that its pipes were uniformly compliant with industry standards. The jury made no findings regarding the physical longevity of any particular piece of pipe. During the damages phase of the trial, the district court granted judgment as a matter of law in favor of J-M on actual damages after the jury was unable to reach a verdict. The court awarded plaintiffs one statutory penalty per project at issue, and not—as the plaintiffs had sought—one penalty for each piece of pipe that had been stamped with the relevant industry standard. The court declined to impose damages, stating that the government had not established that the pipes were value-less.

The Ninth Circuit affirmed, ruling that the plaintiffs were not entitled to recover the entire PVC purchase price without a showing that the pipes had not operated as intended, and lacked all value in light of the jury’s Phase One findings. To the contrary, plaintiffs had successfully installed the pipes and used them for many years following installation without issue, and apparently without any plans to replace the pipes. To award damages in these circumstances, the Ninth Circuit held, would “impose a strict liability standard” without requiring proof of actual damages, and would “conflate[] ‘the materiality element of the FCA claim’ with ‘actual damages.’” Id. at 1174. In considering other cases in which the full contract price was awarded as damages, the court distinguished those cases as involving goods that “were either plainly unusable, not used, or returned.” Id.

The Ninth Circuit also rejected plaintiffs’ claims that statutory penalties should be awarded for each piece of PVC pipe purchased, rather than for each individual project. The court reasoned that the government entity plaintiffs “did not establish how much non-compliant pipe they received nor were they able to identify any specific piece of non-complaint pipe.” Id. at 1172.

The J-M case is an important reminder that there are limits on local, state, and federal governments’ ability to accumulate FCA damages merely because a regulatory violation preceded the provision of goods or services. Time will tell how closely other courts hew to the Ninth Circuit’s admonition that the materiality of a particular regulatory requirement does not automatically mean that goods or services provided after such a violation was committed were worthless.

D. The Tenth Circuit Clarifies a Prior Ruling on the FCA’s Retaliation Provision

In United States ex rel. Barrick v. Parker-Migliorini International, the Tenth Circuit clarified the extent to which an employer must be on notice that a relator is engaging in conduct protected by the FCA in order for the employer to be liable for retaliatory termination. 79 F.4th 1262 (10th Cir. 2023). Brandon Barrick was a senior financial analyst for PMI, who alleged FCA claims regarding two methods of beef distribution. First, according to Barrick, PMI exported beef to Costa Rica, which accepted beef subject to a lower (and therefore, cheaper) USDA testing standard, which would then be repackaged and sold to Japan, which required a higher (and more expensive) testing standard. Second, PMI was allegedly submitting beef to the USDA for testing, indicating that it was being sent to Moldova—when it was, in fact, being sent to Hong Kong, and, in turn, illegally smuggled into China. Id. at 1268–69.

Barrick alleged he had several conversations with PMI’s CFO regarding his concerns, and that the CFO confirmed that PMI was implementing these schemes and that they were illegal. Id. at 1268–69. Over the course of six months, Barrick allegedly cooperated with USDA, DOJ, and the FBI, including by recording several conversations with the CFO. See id. at 1271. Barrick alleged that one month after the FBI raided PMI’s offices, Barrick was terminated as part of a company-wide reduction in force of nine personnel. Id. at 1269. PMI claimed it did not learn of Barrick’s cooperation with the government until nearly two years later. Id.

The FCA prohibits retaliation for “lawful acts done by the employee . . . in furtherance of an action under this section or other efforts to stop 1 or more violations of this subchapter.” 31 U.S.C. § 3730(h)(1) (emphasis added). In 2022, the Tenth Circuit held that to show they were the victim of unlawful retaliation, a relator must show that (1) they were engaging in protected activity; (2) their employer had notice that they were engaged in protected activity; and (3) the employer terminated them because of their engagement in protected activity. Barrick, 79 F.4th at 1270 (citing U.S. ex rel. Sorenson, 48 F.4th 1146, 1158–59 (10th Cir. 2022)). In the Barrick case, PMI argued that to satisfy the notice prong of this standard, “Barrick was required to ‘convey a connection to the FCA.’” 79 F.4th at 1270. Relying on the FCA’s broad protection of “‘other efforts’ to stop [FCA] violations,” the court clarified that relators need not “say magic words, such as ‘FCA violation’ or ‘fraudulent report to the government to avoid payment,’ to put [employers] on notice.” Id. Rather, the person “must have conveyed to [the employer] that he was attempting to stop [the employer] from (1) engaging in fraudulent activity to avoid paying the government an obligation or (2) claiming unlawful payments from the government.” Id. at 1271. The employer “does not need to know the activity violates the FCA specifically.” Id. The court then upheld the jury’s findings that there was sufficient circumstantial evidence upon which the jury could have found PMI was aware that Barrick was engaging in protected conduct.

The Barrick case is significant because it means that, at least in the Tenth Circuit, the requisite nexus between an employee complaint and the FCA may be satisfied by evidence that the employee gave notice she was attempting to stop efforts to claim unlawful payments from, or efforts to unlawfully avoid making payments to, the government. That creates a tension with the text of the FCA’s anti-retaliation provision, which is specific to employee acts in furtherance of qui tam suits or of other efforts to stop a violation of the FCA in particular. Barrick seemingly left open the question of whether the employee herself must believe the conduct she is reporting violates the FCA specifically, or whether it is sufficient that the employee believe the conduct violates any of the myriad statutory, regulatory, and contractual requirements that are often used as the basis for FCA claims.

E. The Eleventh Circuit Reinforces a Strict Approach to Pleading Presentment Under Rule 9(b)

In some federal jurisdictions, including the Eleventh Circuit, to prevail on an FCA claim, “a relator must allege an actual false claim for payment that was presented to the government.” Carrel v. AIDS Healthcare Found., Inc., 898 F.3d 1267, 1277 (11th Cir. 2018) (internal quotation marks and emphasis omitted). In United States ex rel. 84Partners, LLC v. Nuflo, Inc., 79 F.4th 1353 (11th Cir. 2023), the Eleventh Circuit affirmed the district court’s dismissal of an FCA claim based on failure to allege presentment with the requisite particularity.

Relator—an entity called 84Partners, LLC, which included two former employees of a shipbuilding contractor and a pipe fitting manufacturer—brought a false-presentment FCA claim against their former employers, as well as a subcontractor and a pipe fitting distributor, based on the alleged installation of defective pipe fittings on nuclear submarines subsequently delivered to the Navy. Relator alleged that the manufacturer made defective parts and that the other defendants recklessly disregarded their obligations to inspect the parts before delivery or installation, resulting in at least 42 defective pipe fittings being installed on Navy vessels. The Navy made payments for all “allowable costs,” which included costs for parts installed on nuclear submarines, but relator failed to identify “any claim for payment submitted to the Navy that included any of the 42 [defective] parts.” Id. at 1357 (alteration added).

The district court dismissed the relator’s second amended complaint with prejudice, noting that, despite eight years of litigation and limited discovery, relator was still unable to state a claim for false presentment; the court also noted that relator had not requested leave to further amend its operative complaint. Id. at 1358. The Eleventh Circuit affirmed, concluding that although the “complaint allege[d] with particularity egregious underlying conduct,” it failed to “allege with particularity the actual submission of false claims—claims covering the 42 defective parts, or any other defective parts, that made it into submarines.” Id. at 1361. Notably, the government had filed an amicus brief in the Eleventh Circuit, in which it urged the court to eschew a requirement to plead actual false claims—arguing, among other things, that the requirement is a poor fit for cases in which the government is the “only buyer . . . and requests for payment are submitted to one potential government payer under readily-identifiable contracts.” Brief for United States as Amicus Curiae, United States ex rel. 84Partners, LLC v. Nuflo, Inc., No. 21-13673, at 23 (11th Cir. Jan. 20, 2022). The government attempted to contrast such fact patterns with healthcare cases, in which the claims submission process is more complex and involves entities beyond the government itself. See id. While the government made other arguments against the application of a strict Rule 9(b) standard, this explicit contrast between types of FCA cases—and the insinuation that a stricter Rule 9(b) standard may actually have a role to play in healthcare cases in particular—is an interesting window into how the government thinks about different FCA fact patterns.

F. The District of Massachusetts Sets the Stage for a Deepened Circuit Split over Causation in AKS-Predicated FCA Cases

Our 2023 Mid-Year False Claims Act Update discussed the deepening circuit split over the proper causation standard for AKS-predicated FCA claims. In brief, the Sixth Circuit and Eight Circuit have held that the AKS imposes a “but for” causation standard, see e.g., United States ex rel. Martin v. Hathaway, 63 F.4th 1043, 1052–53 (6th Cir. 2023); United States ex rel. Cairns v. D.S. Medical L.L.C., 42 F.4th 828 (8th Cir. 2022), whereas the Third Circuit has rejected a “but‑for” causation standard and instead determined that the FCA and AKS “require[] something less than proof that the underlying medical care would not have been provided but for a kickback.” United States ex rel. Greenfield v. Medco Health Solutions, Inc., 880 F.3d 89, 96 (3d Cir. 2018). Now, the First Circuit is also set to rule on this question after the district court granted interlocutory appeal in two cases with opposite holdings: United States v. Regeneron Pharms., Inc., No. CV 20-11217-FDS (D. Mass.) and United States v. Teva Pharms. USA, Inc., Civil Action No. 20-11548-NMG (D. Mass.).

In Teva, the government alleged that Teva caused the submission of false claims to Medicare through kickbacks it paid in the form of co-pay subsidies in connection with the sale of its multiple sclerosis drug, Copaxone. Both Teva and the United States filed motions for summary judgment on the issue of causation, among other issues. Teva argued that the government must prove “but-for” causation, citing Martin, 63 F.4th 1043 and Cairns, 42 F.4th 828. The government argued that the FCA only requires a “sufficient causal connection” between a kickback and a claim, citing Guilfoile v. Shields, 913 F.3d 178, 190 (1st Cir. 2019) and Greenfield, 880 F.3d 89. On July 14, 2023, the district court in Teva held that “[t]he government need not prove ‘but for’ causation,” and concluded that “[t]he government has established evidence of ‘a sufficient causal connection’ between Teva’s payments to CDF and ATF and the resulting Medicare Copaxone claims.” Teva, 2023 WL 4565105, at *3–4 (D. Mass. July 14, 2023). Thus, the Teva court joined the Third Circuit in rejecting the “but-for” causation standard. On August 14, 2023, the Teva court granted interlocutory appeal on the causation question, finding that the standard for causation is “a controlling question of law as to which there is substantial ground for difference of opinion and an immediate appeal may materially advance the ultimate termination of this litigation.” Teva, Order, Docket No. 235. (D. Mass. Aug. 14, 2023) (internal citations omitted).

In Regeneron, the government alleged that Regeneron improperly sent millions of dollars to an independent charitable foundation to subsidize patient co-pays for Eylea, a drug that treats neovascular (wet) age-related macular degeneration. Similar to the Teva case, both the government and the company filed motions for summary judgment on the causation standard. On September 27, 2023—months after the Teva court issued its ruling—the Regeneron court held that the appropriate standard for causation was “but for” causation and that “the factual evidence is sufficient to withstand summary judgment on the issue of causation.” Regeneron, 2023 WL 6296393, at *13 (D. Mass. Sept. 27, 2023). On October 25, 2023, the Regeneron court certified its decision for interlocutory appeal to the First Circuit on the same question as the Teva case, stating that “if both this matter and the Teva matter were to proceed to trial—and both trials are expected to be lengthy and complex—at least one of those trials would employ an incorrect causation standard, and thus waste considerable time and resources.” Regeneron, 2023 WL 7016900, at *1 (D. Mass. Oct. 25, 2023). The Regeneron court further reiterated that “the issue is one of national importance, as reflected in the split among the circuits as to the correct standard.” Id.

Both cases have been accepted by the First Circuit, but it has not yet ruled. That ruling seems likely to deepen the existing circuit split on the issue of causation. But it remains to be seen whether the addition of another Circuit-level decision will prompt the Supreme Court to weigh in where it has not done so to date. (In October the Court denied a certiorari petition in the Martin case.) This issue carries significant implications for FCA defendants, as exemplified by the $487 million jury verdict in May 2023 against a medical supply company in a case involving allegations of false claims caused by illegal kickbacks. (We covered this case in our 2023 Mid-Year Update.)

V. CONCLUSION

We will monitor these developments, along with other FCA legislative activity, settlements, and jurisprudence throughout the year and report back in our 2024 False Claims Act Mid-Year Update.

__________

[1] Press Release, U.S. Dep’t of Justice, False Claims Act Settlements and Judgments Exceed $2.68 Billion in Fiscal Year 2023 (Feb. 22, 2024), https://www.justice.gov/opa/pr/false-claims-act-settlements-and-judgments-exceed-268-billion-fiscal-year-2023 [hereinafter DOJ FY 2023 Recoveries Press Release].

[2] DOJ FY 2023 Recoveries Press Release.

[3] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Tenn., Dermatologist Agrees to Pay $6.6 Million to Settle Allegations of Fraudulent Billing Practices (July 13, 2023), https://www.justice.gov/usao-edtn/pr/dermatologist-agrees-pay-66-million-settle-allegations-fraudulent-billing-practices.

[4] See Press Release, U.S. Atty’s Office for the Dist. of Vt., Electronic Health Records Vendor NextGen Healthcare, Inc. to Pay $31 Million to Settle False Claims Act Allegations (July 14, 2023), https://www.justice.gov/usao-vt/pr/electronic-health-records-vendor-nextgen-healthcare-inc-pay-31-million-settle-false; United States ex rel. Markowitz et al. v. NextGen Healthcare, Inc., Case No. 2:18-cv-195 (D. Vt.), Settlement Agreement, https://www.justice.gov/opa/file/1305766/dl?inline.

[5] See Press Release, Dep’t of Justice, Martin’s Point Health Care Inc. to Pay $22,485,000 to Resolve False Claims Act Allegations (July 31, 2023), https://www.justice.gov/opa/pr/martins-point-health-care-inc-pay-22485000-resolve-false-claims-act-allegations.

[6] See Press Release, U.S. Atty’s Office for the Eastern Dist. of Pa., Northeast Philadelphia Pharmacies and Their Owners Agree to Pay Over $3.5 Million to Resolve False Claims Act Liability (Aug. 1, 2023), https://www.justice.gov/usao-edpa/pr/northeast-philadelphia-pharmacies-and-their-owners-agree-pay-over-35-million-resolve.